Will I have to pay customs or import taxes for a San Martin Watch?

When considering purchasing a luxury item like a San Martin watch, one question that often arises is whether you will have to pay customs or import taxes. Understanding these aspects is crucial not only for budgeting purposes but also for knowing what to expect upon delivery. In this article, we will delve deeply into the potential customs duties and taxes associated with importing San Martin watches, explain the factors that influence these costs, and provide you with essential information to ensure a seamless purchasing experience.

What Are Customs and Import Taxes?

Customs duties and import taxes are fees imposed by a country on goods brought into the country from abroad. These fees can vary widely based on several factors, including the type of item being imported, its value, and the country of origin.

In most cases, customs duties are a percentage of the item’s value, while import taxes may include sales tax or value-added tax (VAT). Both of these charges can add a significant amount to the total cost of your watch, so it’s important to be informed.

Factors Influencing Customs and Import Taxes for San Martin Watches

Various factors can impact whether you will have to pay customs or import taxes on your San Martin watch, including:

- Country of Purchase: The regulations differ significantly from one country to another.

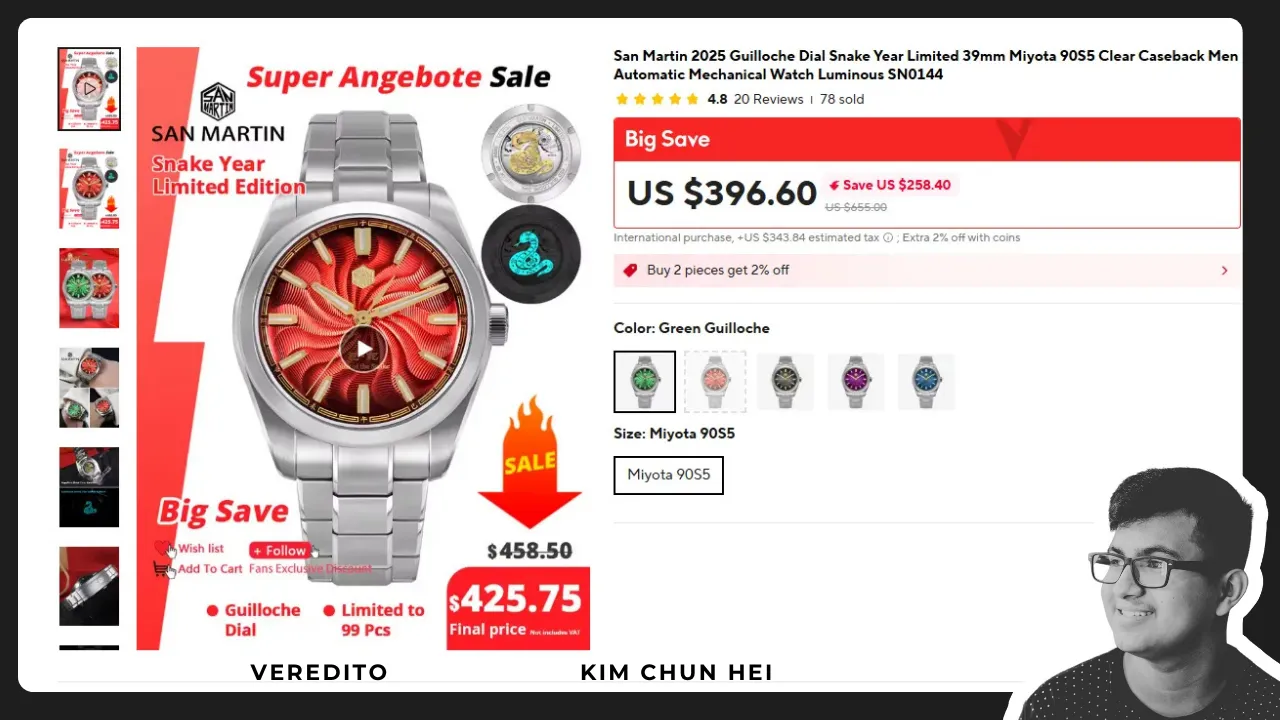

- Value of the Watch: Higher value items are more likely to incur additional duties.

- Country of Origin: Where the watch was manufactured can affect the taxation rate.

- Type of Service: Shipping method can influence whether you will need to pay fees upon delivery.

Country of Purchase

Where you are buying your San Martin watch plays a critical role in determining applicable customs fees. For example, purchasing from a retailer in the U.S. may have different customs implications compared to buying from a base in Europe or Asia.

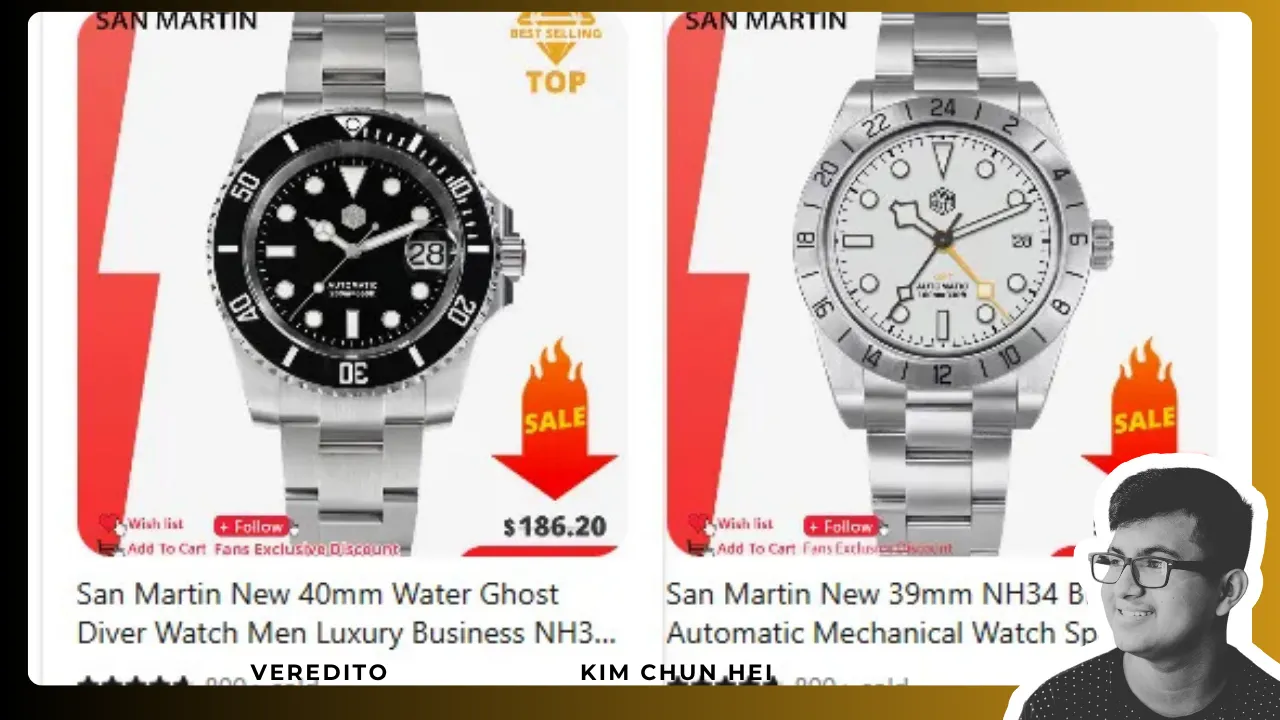

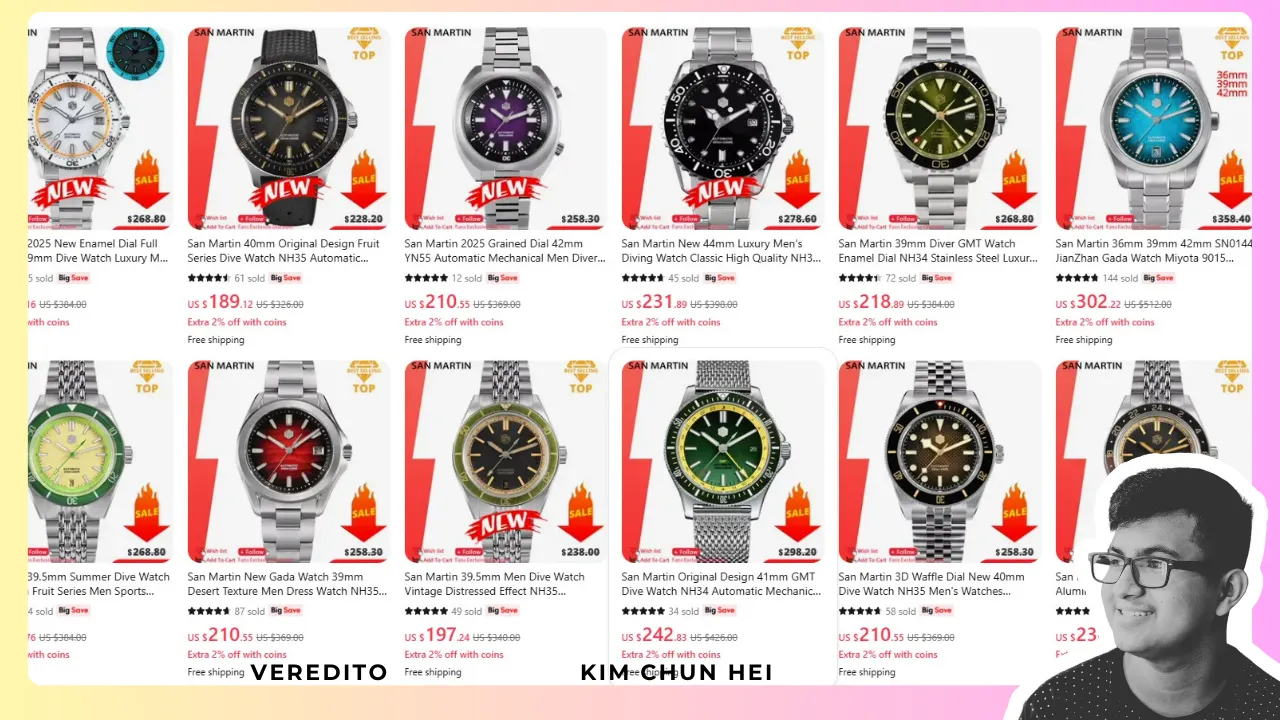

Value of the Watch

Customs authorities typically have a threshold value for imported goods. If your San Martin watch surpasses that value, you may be subject to additional taxes. It is essential to check the specific thresholds in your country before making a purchase.

Country of Origin

The country where the watch was manufactured can also influence customs duties due to trade agreements or tariffs that the importing country has with that nation. Always check for any bilateral trade agreements between your country and the country of origin of the San Martin watch.

Type of Service

The shipping method you choose can impact whether you’ll incur taxes. For instance, expedited shipping may subject you to different custom clearance processes compared to standard shipping options.

Estimating Customs and Import Tax Costs

To estimate the potential customs and import taxes on your San Martin watch, take the following steps:

- Determine the Total Value: Calculate the total price of the watch including shipping and insurance.

- Check Duty Rates: Look up the duty rates for watches in your country’s customs website.

- Account for Additional Fees: Consider any other fees that might apply based on shipping and handling.

Using Duty Calculators

Some websites provide duty calculators that can help you estimate potential import taxes based on the price of your watch and your location. Enter the necessary details to receive an estimated cost.

How to Avoid Unpleasant Surprises

To ensure a smooth purchasing experience and avoid unexpected charges when importing a San Martin watch, consider the following tips:

- Research Your Country’s Import Regulations: Knowing the laws governing imports in your country can help you anticipate any possible fees.

- Ask the Seller: Inquire whether the seller provides information regarding potential customs duties and taxes.

- Keep Documentation Handy: Always keep receipts and documentation related to your purchase in case you need to provide proof of purchase to customs authorities.

Common Misunderstandings About Customs and Import Taxes

There are several misconceptions about customs and import taxes that potential buyers often hold. Here are a few:

Myth: All Imported Watches Are Taxed Equally

In reality, customs duties vary based on the value, origin, and type of watch being imported. Each country has its own specific tax structure that greatly influences how much you’ll ultimately pay.

Myth: Shipping Method Doesn’t Matter

This is not true; different shipping methods can incur varied customs processing fees. Always clarify shipping details to understand any potential implications.

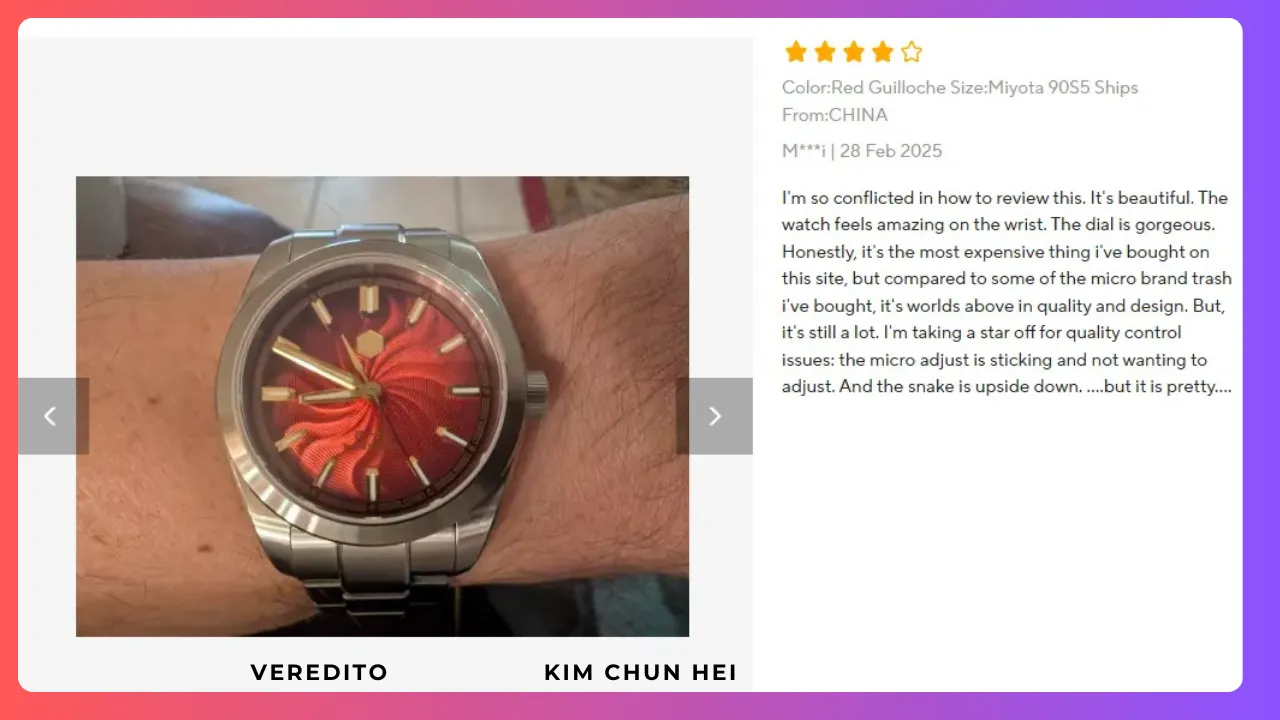

Real-Life Scenarios of Paying Taxes on San Martin Watches

Understanding real-life cases can provide clarity on how these customs duties work. Here are a couple of scenarios:

Scenario 1: Importing from the U.S. to the EU

Imagine purchasing a San Martin watch priced at $500 from a U.S. retailer and shipping it to a country in the EU. Depending on the country, you might face a customs duty ranging from 5% to 20% of the total value, alongside potentially incurring VAT, which could be another 20% depending on your specific location.

Scenario 2: Importing from Asia to Canada

Now consider buying the same watch from an Asian retailer. Canadian customs may have a different duty structure, potentially exempting lower-value items. However, any watch priced over a certain threshold will still attract related taxes.

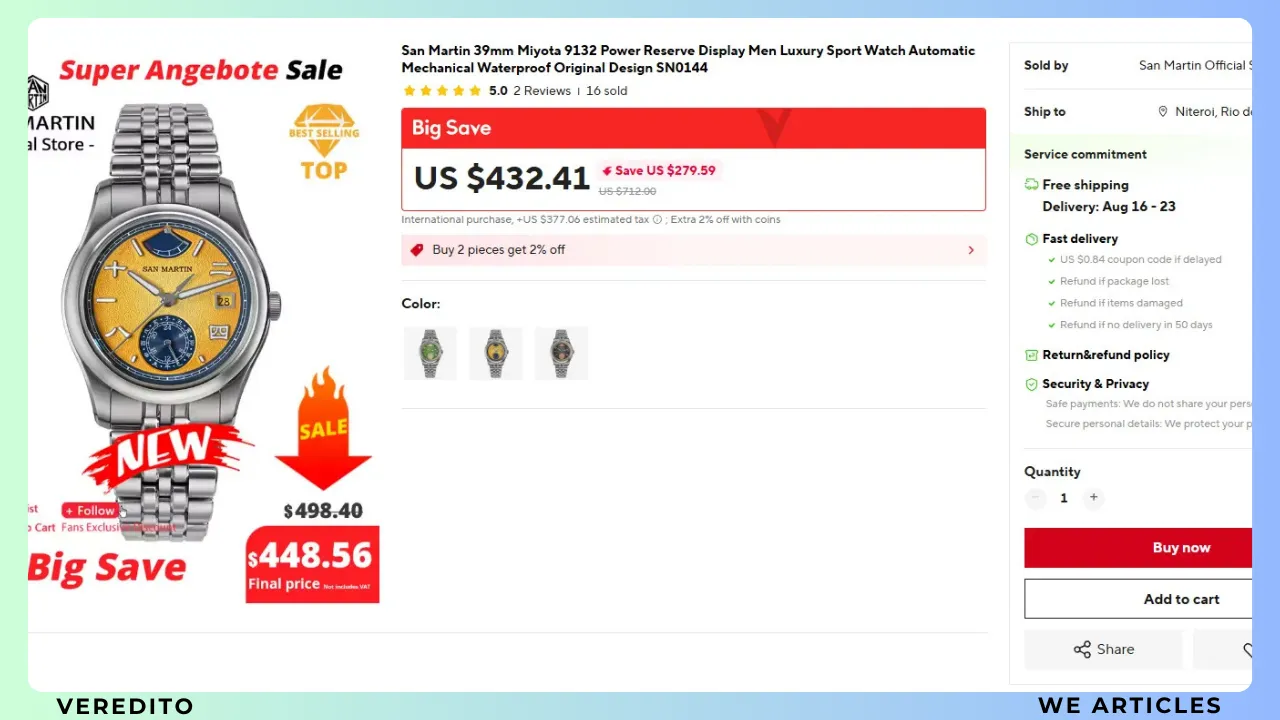

Does Buying Through an Authorized Dealer Help?

Purchasing your San Martin watch through an authorized dealer may provide you with additional benefits such as:

- Warranty Protection: An authorized dealer often provides product warranties that can alleviate repair concerns.

- Clearance of Taxes: Some dealers may handle customs clearance for you, bundling the expenses in your purchase.

Final Considerations When Purchasing a San Martin Watch

Before making a purchase decision, take a few moments to ensure you are fully informed. Whether you decide to buy online or from a local authorized retailer, understanding potential import fees will lead to a more satisfying purchasing experience.

The allure of owning a San Martin watch is strong, offering both reliability and style. By being prudent and knowledgeable about customs and import taxes, you can ensure that your new timepiece arrives without a hitch.

In summary, being proactive about your purchase can make all the difference. Spend some time doing research, communicate with your seller, and prepare for any potential fees. When equipped with the right information, owning a San Martin watch will be a joyful rather than stressful experience.

When considering the purchase of a San Martin watch, it’s essential to understand the potential customs and import taxes that may apply. Each country has its own regulations regarding imported goods, which can affect the overall cost of your watch. To avoid unexpected expenses, thoroughly research the customs policies in your country. If applicable, keep in mind that some online retailers may provide estimates for potential duties and taxes. By being informed and prepared, you can enjoy your new watch without surprises and appreciate the quality and craftsmanship that San Martin watches offer.

FAQ

Will I have to pay customs for my San Martin Watch?

Yes, you may have to pay customs fees if your San Martin watch was shipped from abroad. Customs duties are determined by your country’s regulations and the watch’s value.

How are import taxes calculated?

Import taxes are calculated based on the watch’s declared value, shipping costs, and any applicable tariffs. Check your local customs website for specific rates and calculations.

Can I avoid paying import taxes on my San Martin Watch?

Unfortunately, there’s usually no way to avoid import taxes entirely. However, some companies may offer lower shipping values to help reduce costs, but this is not recommended for legal reasons.

What should I do if I receive a tax bill?

If you receive a tax bill, you must pay it to retrieve your package. Retain the invoice and receipts for your records, as you may be able to claim these expenses on your taxes.

Does the retailer provide information about customs fees?

Some retailers may provide information about potential customs fees on their websites. It is advisable to check their policies or contact their customer service for details before purchasing.

Conclusion

Being informed about customs and import taxes can significantly enhance your buying experience when purchasing a San Martin watch. Understanding these potential costs will help you budget accordingly and avoid surprises upon delivery. While customs fees may seem daunting, they are a necessary part of importing goods. By doing your research and planning, you can confidently invest in a quality timepiece and enjoy the sophistication and craftsmanship that comes with it. Happy shopping!