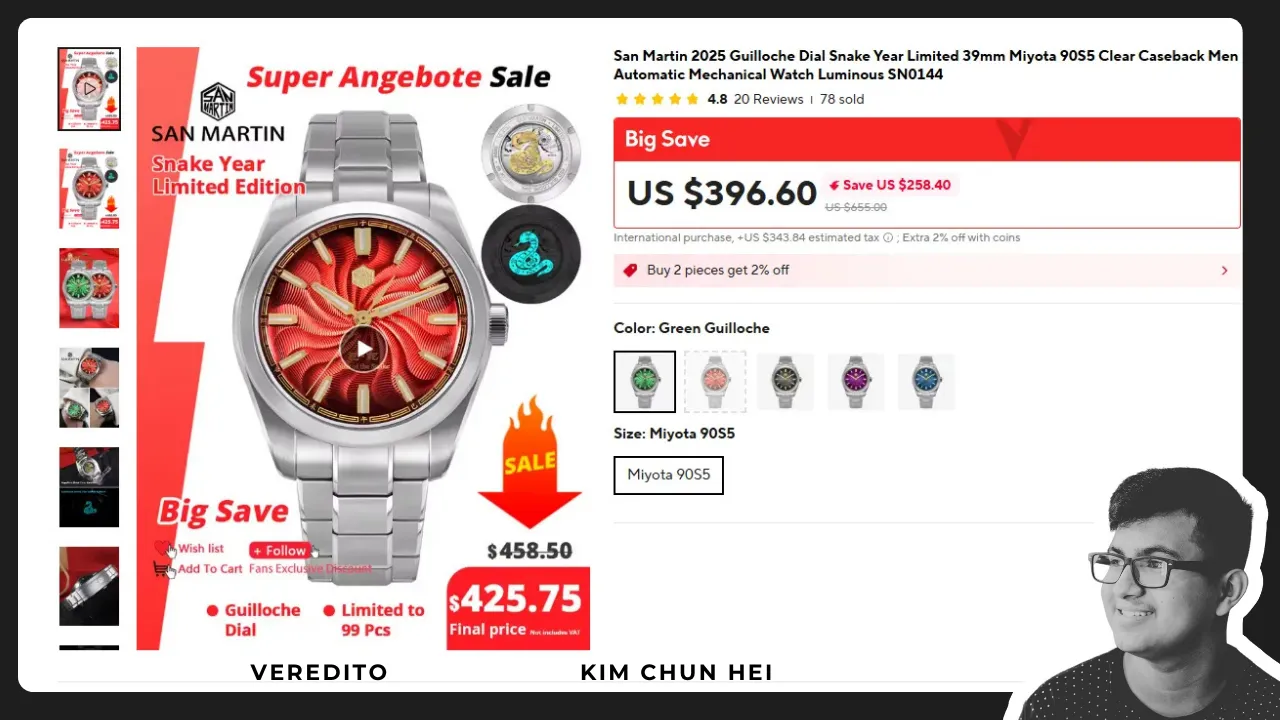

How do import taxes affect the final cost of a San Martin Watch?

A watch is not just a tool to tell time; it’s a statement of style, sophistication, and craftsmanship. Among the many brands, San Martin Watches have gained attention for their quality and luxury appeal. However, many buyers often overlook a crucial factor that can significantly impact the final purchase price—**import taxes**. In this article, we will explore how import taxes affect the final cost of a San Martin Watch, helping consumers to make informed decisions while shopping for their desired timepiece.

Understanding Import Taxes

Import taxes, also known as tariffs or customs duties, are fees imposed by a government on goods brought into the country. These charges can vary significantly depending on the country of origin, the type of product, and the specific regulations of the destination country. When it comes to items like luxury watches, import taxes can represent a substantial percentage of the total purchase price.

Types of Import Taxes

There are several types of import taxes that might affect your San Martin Watch purchase:

- Customs Duty: A tariff on the value of a good when it crosses international borders.

- Sales Tax: A tax imposed on sales of goods and services, which may also apply to imported items.

- Value Added Tax (VAT): A type of indirect tax that is levied at each stage of production or distribution, usually calculated on the final retail price.

How Import Taxes are Calculated

The way import taxes are calculated can depend on several factors:

- Value of the Watch: The base cost of the San Martin Watch is the primary factor for calculating import taxes.

- Shipping Costs: Additional charges for shipping may also be included in the calculated value for import taxes.

- Customs Regulations: Each country has its own set of rules that dictate how much duty is applied.

Example Calculation

To better understand how import taxes work, let’s take an example:

- Assume a San Martin Watch retail price: $500

- Shipping Cost: $50

- Total Value for Tax Calculation: $550

- Customs Duty Rate: 10%

- Calculated Import Tax: $55

In this scenario, the final cost of the San Martin Watch would rise from $500 to $555 due to import taxes.

Impact of Import Taxes on the Final Cost

Import taxes can add a significant amount to the final purchase price of a San Martin Watch. As we have seen in the previous example, these extra charges can range from a small percentage to a substantial amount depending on the country and applicable regulations.

Notably, these taxes can lead to the following financial implications:

- Increased Overall Cost: For buyers, the end price of a watch can exceed the original retail price by a considerable margin.

- Market Variability: The fluctuation in import taxes may change frequently, causing inconsistencies in watch pricing.

- Informed Decisions: Understanding import taxes helps consumers make wiser choices and assess whether a specific watch fits their budget.

Different Countries, Different Import Taxes

Import taxes vary widely by country. Here are a few examples:

United States

In the U.S., the tariff rates for watches can range significantly, generally falling between 0% to 20%, depending on the specific type of watch and other factors.

European Union

For buyers in EU member countries, VAT typically applies, which can be around 20% for luxury items. Additionally, customs duties may also apply, depending on the country of origin.

Canada

Canadian import duties on watches can be around 8% to 10%, plus applicable provincial sales taxes that can raise the final cost further.

Strategies to Minimize Import Costs

While you may not be able to eliminate import taxes altogether, there are several strategies to lessen their impact:

- Shop Locally: Whenever possible, choose a local retailer to avoid hefty import fees altogether.

- Rainy Day Sales: Keep an eye out for sales and discounts that may offset these costs.

- Consult Experts: Seeking advice from customs specialists can clarify how much you should expect to pay.

- Consider Return Policies: Ensure that the retailer has a flexible return policy if you feel that the watch is not worth the inflated price due to taxes.

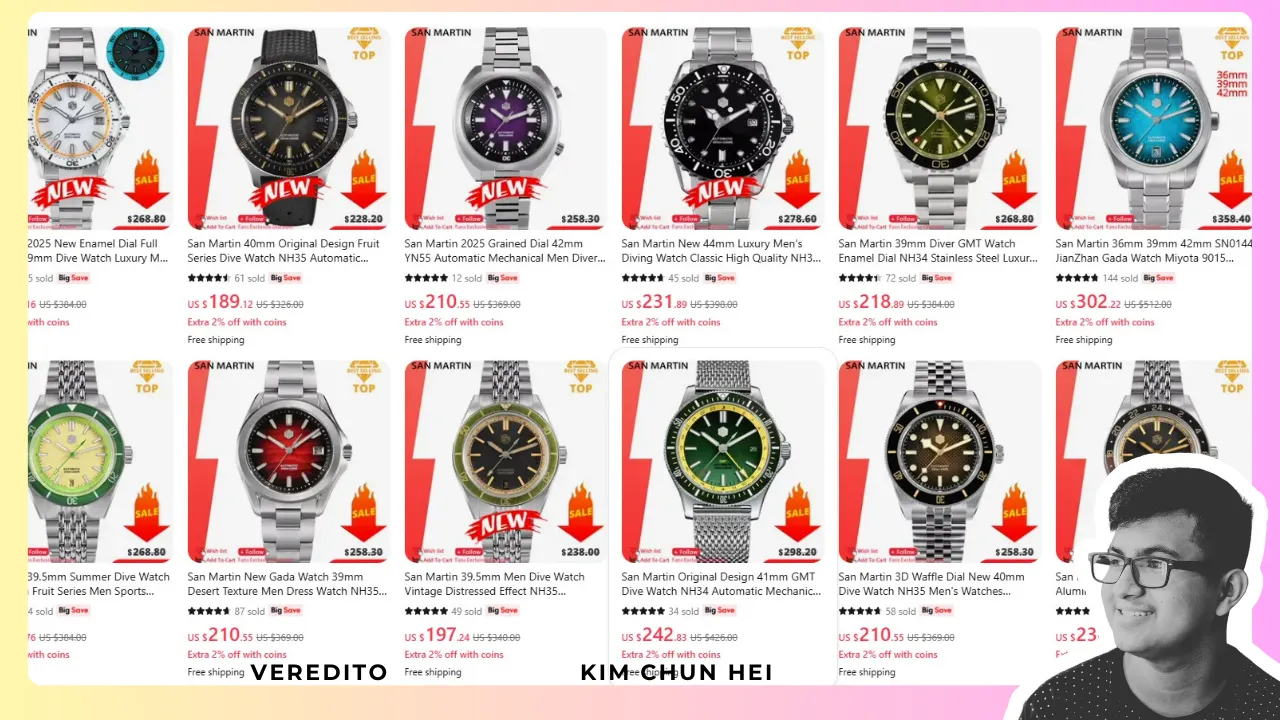

Why Invest in a San Martin Watch?

Despite the potential additional costs associated with import taxes, investing in a San Martin Watch can still be worthwhile for numerous reasons:

- Quality Craftsmanship: San Martin is known for its superior craftsmanship and attention to detail.

- Resale Value: These watches tend to hold their value well, making them a sound investment for future resale.

- Stylish Design: The aesthetics of a San Martin Watch can elevate any outfit, offering versatility.

Final Thoughts

While import taxes undeniably affect the final cost of a San Martin Watch, understanding these additional expenses can empower consumers. By being informed about the tax rates applicable to your location and how they impact the purchase price, you can better assess your budget and make educated decisions. Ultimately, the investment in a San Martin Watch can deliver quality, style, and value that justify the costs, even when import taxes are included.

When considering the purchase of a San Martin Watch, it is essential to understand how import taxes can influence the final cost. These taxes are government-imposed fees on goods brought into a country, which can significantly elevate the overall price you pay. Depending on your location, tariffs, VAT, and other customs duties can add up, sometimes reaching a substantial percentage of the watch’s base price. Therefore, being aware of these costs can help you budget correctly, ensuring that you make an informed purchasing decision without the surprises that hidden fees might bring.

FAQ

1. What are import taxes on San Martin Watches?

Import taxes are tariffs and fees imposed by your country’s government on goods imported from abroad. For San Martin Watches, these can include customs duties, VAT, and other charges based on the watch’s declared value.

2. How do I calculate the import tax for a San Martin Watch?

To calculate import tax, check your country’s tax rates for imported goods. Typically, the formula includes the basic watch price plus shipping costs, multiplied by the applicable tariff rate. Always refer to your customs office or official website for precise calculations.

3. Can I avoid import taxes when buying a San Martin Watch?

Avoiding import taxes is generally not possible, as most countries enforce them strictly. However, using local retailers or authorized dealers may help you sidestep additional fees associated with international shipping.

4. What happens if I don’t pay the import tax?

If you fail to pay the import tax on your San Martin Watch, customs may hold your package or return it to the sender. In some cases, additional fines may apply, complicating your purchasing experience.

5. Are there any benefits to paying import taxes for high-value watches?

Yes! Paying import taxes can ensure that your purchase remains legal, giving you access to warranty services and protection against counterfeit products. Additionally, legitimate transactions contribute to your country’s economy.

Conclusion

Understanding the implications of import taxes is crucial for anyone considering a San Martin Watch. These taxes can affect your total investment, making it essential to plan ahead. By calculating these costs beforehand, you can enjoy the quality and craftsmanship of a San Martin Watch without unexpected financial burdens. Investing in such a timepiece is not just about the watch itself, but the entire experience surrounding its purchase. So, be informed, budget accordingly, and treat yourself to a piece that signifies both style and quality.